My position on the present economic ideologies is ...

- Most economic experts are often little more than knowledgeable accountants who believe with reasonable certainty that they are right ... while, at best, most of them are half-right. Economists can't escape the tinge of politics of the lure of industry funding, no matter how much they pretend.

- Economists tend to concentrate at opposite ends of a left-right spectrum of orthodoxy, with the older followers of John Maynard Keynes on the political left, and Friedrich Hayek and Milton Friedman on the right.

- Probably most economists would now agree that the upgraded version of Keynesian viewpoint are more correct than the Hayekian neo-liberals (aka the "Austrian School", neoliberals, or "Libertarians") These theories have now been largely discredited and abandoned, but many right-wing businessmen cling to them.

- However the "neo-Keynesian" form which is common in current economics still has the vestiges of their old problems in treating money as is it were somehow 'real', and consequently holding a position that the government is within the circulatory system in the economy. They cling to beliefs that governments need taxation to fund their programs, staff salaries and new projects.

- The Chicago School of Monetarists were a neoliberal offshoot which exaggerated the importance of money in the free-market, and they generally believed that government's mainly had disruptive effects. Milton Friedman was their main guru: his theories are generally discredited now. He blamed government for inflation, and promoted mass privatisation.

- The Australian wave of New Monetary Theorists have created a view of economics which is a vast improvement on all these more traditional views. However I believe that they also make some fundamental errors, mainly in ascribing the creation of money only to the Federal Government.

Neo-Keynesian Economics is now the flavour of the month.

The older Keynesian theories of economics have returned, but in a modified form. While I still maintain some objections to this approach because I believe it still had many of the misleading concepts I've identified here; mainly because they seem to assume that money is real. In that, they pander to the public view about the primary importance of money.

These New Monetary Theory (NMT) ideas have begun to permeate widely, and they have a distinct ecological-sustainable flavour. There these concepts were co-developed by Emeritus Professor Bill Mitchell at University of Newcastle (NSW), and Richard Denniss at the Australian Institute. Many of these ideas have been incorporated here.

This web-site is a composite of thirty years of reading and analysing, with some interpretative concepts that I believe I can bring to the subject. I generally believe that the constant arguments between these ideologies, and the influence of politics and popularism, has constructed an academic edifice with more fixes, patches and structural repairs than the subject justifies.

Experts tend to create complexity. They often become rigid advocates for selected viewpoints.

You may think that I've gone too far back to the basics in these first sections, and that I'm spend too much time nit-picking definitions. But my defence would be to claim that:

- Economics is only about half as complex as it seems.

- Economists, like all experts, have vested interests in maintaining complexity.

- If you get the basics right, some of the confusion quickly disappears.

|

Just to convince you that I am not just promoting another of these half-right/-wrong theories:

Let me just provide a few quick examples:

- If you've read some formal economics texts, you will probably have been told that "money is a Government Promissory Note" or that money is "a standardised form of government IOU".

Both are vaguely right, but when you dig deeper into what these words imply, you find that they obscure more than they explain. The government is not guaranteeing you anything of value. It only promises that money will be difficult for people to counterfeit, which would destroy its purchasing power.

- You've probably always accepted that a dollar of Australian currency is a universal "standard unit of wealth" in the nation.

One of the early chapters deals with this confusion. It is neither a 'standard', nor does it 'measure wealth'. And "wealth" can be defined so widely as to be almost a useless term. "Value" is not much better (it depends on the context).

- If you are moderately independent and a newspaper reader, you'll probably agree with the statement that "When governments run deficits, they begin to print more money -- which creates inflation".

Again, this is half-right. But it shows a confusion between 'money' and 'currency'. And how do you print electronic money? Or perhaps,"what is it that stops them from printing all they want?"

- If your inclination is to vote for the Labor Party, you probably accept that inflation is 'caused' by greedy industrialists, supermarket duopolies, and general business owners raising prices.

In fact, corporations raising prices in an inflationary environment is a totally rational action. If they didn't, they would suffer from the increased cost of their own inputs -- one of which is 'labour'. The 'Labour Theory of Value' (LTV) in fact, promotes the idea that it is the incremental additions of labour inputs which set the final price of everything.

- If you are a Liberal Coalition voter you probably accept that unreasonable wage demands, 'create inflation' via the wage-price spiral. This claims that worker's don't gain much benefits from wage increases, because these additional costs also increase matching prices. It appears to be looking at only one side of the ledger.

If money is travelling in a circular way in the free-market, then salaries and profits are just two variations of income; while prices and salaries are both also costs.

- You might distrust politicians and think that inflation is 'caused' by both self-serving greedy industrialists and lazy workers, all wanting more money. Since they are also the sector of the population that produces everything ... the question is: "more than who?"

It has probably never dawned on you that the Australian economy lacks any benchmarks for salaries or markups or corporate returns. If we could create some benchmarks it would lead to stability in the dollar's purchasing power. As customers, we use commonsense experience and remembered "benchmarks" to judge the quality and price of everything.

- If your inclination is for less government, and fewer bureaucrats.

You probably believe that there is some transcendental magical force within this extraordinarily complex exchange system which can be relied upon to intervene. Without intervention and automatically forces which make corrective price adjustments, there is no way to maintain an innate fairness in the nation's distribution of all of the commercial benefits.

Most of this web-site is designed to correct some of the more destructive of these delusions and confusions ... and also to avoid some of the political partisan-thinking. Since I am not an academic economist but rather an opinion columnist, I will be taking an advocacy position on occasions.

|

The problems of terminology 'inexactitude'.

If you accepted in that statement above that the dollar is a "standard unit of wealth measurement", then you've succumbed to a classic logical trap, which is the imprecise definition of words. Without tight definitions, people draw different inferences from many important statements, whether or not these are correct and based on fact.

It's my opinion that the study discipline of academic economics:

• Uses a lot of undefined terms, which can carry different implications. This leads to confusion.

• Lacks necessary terms and labels to simplify many of their most important concepts.

• Tends not to match the discipline's usage of terms with what is common usage. This creates popular misunderstandings.

|

Examples: Let's just quickly examine some terms and concepts to give you some idea of just the initial economic problems I see:

- The claim that the dollar is a standard unit implies that it is something like the international standards of length, the metre ... or of volume or weight (litre/kilogram). I learned in my schoolboy days that every metre rule or tape-measure in the world is rigidly checked against a platinum-iridium rod held at an exactly stable temperature at a museum in France. Since 1960 it has been based on the wavelength of light emitted by krypton 86.

- Every metre-rule in the world is supposedly the same length.

- This has been the case for a few hundred years. It doesn't vary.

- This is part of the "SI" group of standards. A volume of 1 litre is a cube measuring exactly 10 x 10 x 10 cms.

- One kilogram is the weight of a litre of pure water, again, held at a fixed temperature to prevent expansion.

The dollar 'unit' is nothing remotely like these. It changes in its purchasing power by the day.

- But elasticity measurements can still determine shares!

Imagine having a kilometre of tape-measure made from an elastic rubber-band. It might be accurately marked with the metric measurement units along its length. But the strap can be stretched or relaxed to suit any logical case being mounted, so it is useless for measuring 'amount'.

The point is that while the tape might be precise in its markings it will vary in the numbers of unit-sized proportions measured ... depending entirely on how much it has been stretched.

However ... NOTE: that with any degree of stretch, it can still provide a benchmark indication as to where the 'half-point' mark is, or what is one-eighth of the overall length. It can still accurately determine SHARE or PROPORTION.

This is the point: Such varying standards can provide percentage or shares, even when they can't

provide any accuracy in measuring amounts. Money is like this.

- The dollar is supposed to 'measure wealth'... or the alternative term widely used is that of 'value'.

Yet money exists in an inflationary environment where the purchase power of each dollar changes by the week. - How can a standard measure 'value' anyway?

- How can it be appropriate, except on a strictly temporary basis?

• Of course it can't help us measure anything meaningful in the long-term unless it is a fixed standard.

• And the word "wealth" is an vague abstract ranking-concept only ... it's at the other extreme to 'poverty'.

• The term "value" can mean anything from "essential' ... to 'useful' ... up to 'passionately desired'.

These are just vague ranking categories of highly-subjective judgements, without any attempt at precise meaning.

- What salary range to we find acceptable?

• If some people earn two or three times the average, we'd probably all accept this.

• If other wage earners were down to half to a quarter the average, we'd possibly find it acceptable.

• However we tolerate a system where the highest income is a hundred times or more the average!

- Yet in economics, the Australian dollar is often automatically thought of as if it were providing a standard for precise measurements -- and often used to compare changes in real production and consumption over time.

- 'Wealth' is vague enough to mean anything. There's an arguable case that the Earth's remaining natural wealth (untouched environment) must be valued and regarded as a primary factor in our collective 'wealth'.

- The evidence for climate change suggests that this factor, coupled with global population growth (which the UN has projected will be 11.2 billion by 2050), will tip the balance of well-being for everyone on the planet, way past any hope of sustainability.

• Yet population growth in Australia is regarded as an economic plus, rather than a minus.

• Economists maintain that we need population growth to support an aging citizenry.

• Apparently (based on this logic) migrants don't age.

- Regulations to restrict population growth will require about two or three-generations (50-75 years) to make much difference. Every generation has the right to desire a family size of their own choosing - unless draconian measures are introduced.

• If Maoist's draconian rules aren't planned, then reductions must begin to be implemented now; they are far more important for the 'wealth' of future generations than inflation and mortgages.

- Productivity improvements are widely believed to offer the solution -- yet a century ago our grandparents probably had a standard of living not greatly inferior to us today.

• We probably shouldn't be cutting down tropical rainforests to make expensive apartment furniture;

• Nor should we be able to buy a Lamborghini as our second car when an electric golf-buggy is probably all we need to get to the railway station or bus-commuting depot.

- And we need to talk about such everyday matters as money and currency which are terms we all use almost interchangeably, when they represent quite different aspects of our monetary system.

|

Money and Currency:

At one time they had some important distinctions: currencies were 'physical objects' made of paper or metals, and money was the 'valued' entitlement that was attached to the currency. This appears to be a fairly trivial distinction, but confusion of these two has some substantial consequences in the way we generally think about the way the economy functions.

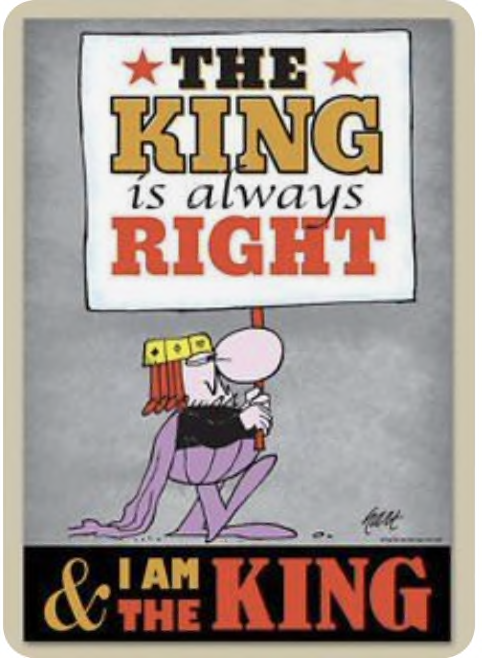

We still have our childhood fairy-tale cartoon depictions of kings with vaults of taxed gold coins (currencies). The king would dole out a bags full of cash to his lackies to pay for the army or for some other project. This idea perpetuates the false concept that money is something real, and that it cycles back through taxation to the governing authorities, who then dole it out to fund their various projects.

You've probably never even thought of this distinction, and yet 'entitlements' (money) and a 'authentication' (the role of currency) are the key to understanding how governments fund their projects. The free-market, of course, is in the business of generating real goods and services, and of exchanging these between all citizens using the "entitlements" of money. You wouldn't accept Calithumpian Zeno banknote entitlements as payment for your car because you have no way of authenticating that they are acceptable to your bank, or to anyone else you may wish to purchase goods from.

Entitlements: The main point to note is that anyone can create entitlements. I can tell you that I will give you a cake on your birthday, and within the bounds of our friendship I have created an entitlement. You can anticipate that this will be honoured by virtue of our relationship: you know how much I can be trusted.

So the 'entitlement' will always be trusted only to the degree it can be 'authenticated'. And for transfer of an entitlement in any sort of national economy, it must be accompanied by a universally-recognised and accepted authentication. And in Australia, for general day-by-day purchases, that means the State and Federal Governments. At one time each Australian colony had its own money, and that money was only valid within the State.

If I were to create a more substantial entitlement today, say to the occupancy of a house or building I claim to own, you might feel it necessary that I put the grant of that entitlement in writing. You will want me to provide details that you can authenticate (ie. proving that I own the house) and you'd want me to sign a formal rental agreement. This process then becomes a contract, provided only that it is made out to a specific person, company, entity, etc.

It will usually have conditions such as the provision that you agree to pay the weekly rent and keep the place clean. This form of entitlement has good legal standing, and you will want this form of security -- and therefore you need to trust our agreement enough to use the rented premises as headquarters for your business.

However, what is not quite so clear (legally) is when the entitlement documentation has been made out vaguely "To the Occupier" (rather than a specific entity or person). Money is like this because the entitlement is awarded to "The Holder."

If the rental agreement had been made out vaguely to the occupancy of the premises, it then becomes tradable. But note that neither the issuer or the recipient of the entitlement necessarily know each other. In these circumstances, each potential occupier will need to be sure that the original source of the entitlement can be trusted to actually own the property, so now the authentication process become crucial.

The authentication of entitlement now needs to be traceable back to someone (or some entity) universally trusted. At this point in this analogy, we have something in the lease document that is very similar to currency -- with the abstract entitlement being a transferable rented space.

So the components that make money useful for our everyday exchanges are:

• The entitlement (the money component) must be spelled out clearly in unit form.

• A traceable pathway must exist, back to some universally trusted entity (State or Federal governments).

Money and the physical form of currency have both of these.

|

Entitlements and tokens

I'm over-explaining this because I want to make sure you understand that that money is not something mysterious or unique or difficult to understand. It is simply an abstract, government created, 'entitlement' in a physical unit form called 'currency'.

For example: here is another 'entitlement'. When I drive into my supermarket car-park,  I press a button to raise the barrier, and the machine delivers me a physical token which is my "authorisation". This "authorisation" is evidence that they are entitling me to two hours of free parking I press a button to raise the barrier, and the machine delivers me a physical token which is my "authorisation". This "authorisation" is evidence that they are entitling me to two hours of free parking

Anyone can issue "entitlements" to access or use anything they own or control. The ticket-token is the physical "authorisation" which is the physical and legal evidence that they have the right to issue such entitlements. This is simply because they own the parking area.

Our Six State and Federal governments are given the authority to control everything produced in the country, and they circulate these entitlements in money unit form to "The Holder". These abstract entitlements are authenticated either by physical coins or paper banknotes, or nowadays electronically.

This distinction is important for every Australian citizens' ability to trade ... for a couple of special reasons that are not obvious to everyone. Yet the granting of 'entitlements' is the prerogative of all people and all businesses ... not only governments. Authentication just provides evidence that money is acceptable when passed around.

It's really that simple.

|

Brief history of money

There are historically four different phases in the evolution of our money supply, and I've experienced the latest three in my lifetime.

- Money was made out of precious metals (mainly gold) by the Romans, and the practice continued up to about the time of the Norman Conquest of Britain (1066). Gold only had 'utility value' as jewellery because it didn't tarnish, and it was rare and associated therefore only with aristocrats and others with excessive wealth.

This introduces a couple of important ideas:

- Pretzel logic: which is the art of twisting an argument back on itself.

People think of gold as intrinsically 'valuable'. But to the peasant, gold only had value [??] because it was used in coins ... otherwise it was worthless from any utilitarian viewpoint. We often view ideas from Left-to-right, when they can equally be viewed Right-to-Left.

- Benchmarking: The only real value of gold coins to 12thC peasants was that the rare metal discs established "benchmarks" for making some purchasing judgements. In a barter-economy, every judgement is simply made from the viewpoints of the pair involved: the buyer and the seller. Money created a wide-spread "benchmark" for comparison.

This was important guidance in the middle ages, and to a degree it is still important today. Benchmarking is how we make most of our purchasing decisions, by judging the object's 'worth' to us as individuals, partly on the sale price, but also on the basis of previous experience.

I'll return to Benchmarking later: it is a term we apply to a "slightly-vague judgement". And we use benchmarking today in most of our purchasing decisions because, with the purchasing-power changes in each dollar, constantly changing prices, and tens of thousands of similar products, we need to rely more on these vague memories and benchmark indicators.

- After the Norman Conquest most coins were made from lower quality metals like copper and silver. So it wasn't any actual value of the metal that made them useful in commercial exchanges -- it was just the abstract entitlement that money represented.

Both the authentication evidence and the units of entitlement were carried by the numbers and profiles impressed on the sides of the coins.

Coins were difficult to make without specific dies and stockpiles of the standard metals, so this rarity of materials and the difficulty in machining the tools required provided most of the authentication factor: it wasn't worth the effort. And, with coins, the abstract money-entitlement and the physical authentication factors were inextricably linked.

- Banknotes were an idea that Marco Polo brought back to Europe from China. With this change, they effectively divorced the 'entitlement' units from the 'authentication' because banknotes were really nothing other than a piece of printed paper. The authentication lay in the difficulty of duplicating the paper of a certain quality, with hidden identifiers such as special fibres in the paper-making. They also hanged counterfeiters in those days, which tended to discourage people from making their own until colour photocopiers became readily available. Today they use a special form of polymer.

- Electronics: The Bankcard was introduced into Australia in 1964 when the private banks created a common electronic system. This was ten years before Whitlam's Trade Practices Act of 1974 made it illegal for companies to collude in setting prices or carving up exclusive rights to territory. The Australian Bankcard people then did a deal with the international credit-card operators, Visa and MasterCard.

Of course the sum of your entitlements in Australian dollar units still exist as numbers held in the private memory location of your bank's computer database. But the old authentication role of the physical currency has now been superseded by bank controls and auditing, and by the fact that the two accounts involved in the money exchange can be instantly compared to ensure that the reduction in dollar amounts in one, exactly matches the increase in dollar amounts in the other.

So why do we bother still making the distinction between entitlement and authentication?

The key value of retaining the concept of these two distinct entities, is that these together create the base-line units for our whole system of monetary exchange.

If you don't understand this, then you are like a carpenter or builder who doesn't understand the difference between the old imperial yards/feet and inches, and the metric system of metres/centimetres and millimetres.

What's more, the importance of this distinction extends to pricking the bubble of confusion that has led people to invest in that Ponzi scheme called BitCoin and other crypto-currencies. It also help explain those incorrect ideas about money circulating (supposedly) endlessly through our governments and the wider economy.

Sovereign Authority

The founder of modern economics, Adam Smith, lived about the time Australia was first being colonised. But economics has developed over the years since those days ... and the world has seen adherents to extreme political and economic ideologies fighting for control, resulting in enormous confusion. We've had all those political years of global turmoil involving Communistic and Socialistic uprisings, with nationalisation of ex-government enterprises ... followed by the Liberal-Conservative privatisations of just about everything.

Yet this has left us with huge terminological gaps in our vocabulary. What's more there's been a blending of political ideologies and economic theories. For the lack of simple terms to cover a simple concepts, thousands of erudite academic papers have been written which profoundly explaining some fallacies and some realities ... which are often as plain as the nose on your face.

So I can only apologise for adding marginally to this maelstrom of confusion, by reviving some terms that have gone out of fashion.

- One of these is "Sovereign Authority". This is nothing more than a simple term referencing the functions of all governments -- as granted to them all by "the people". In any democracy, the people are the Sovereign Authority, and we have both State and Federal governments represent our interests. We are jointly the Sovereign Authority: while they are elected to do the spade work.

In bygone days we used to call this abstract entity "The Crown" and pretend that all power and authority governing the Australian nation emanated from some male or female wearing some gilded metal object held somewhere in Balmoral Castle in the UK. But let's get real!

We can categorise the economy into two quite distinct, major sectors:

(A) this government authority with a focus on fairness and the common good. This is the sector which is elected in order to serve the 'common good' in every way, from our defence, to cleaning public toilets.

(B) the free-market with its emphasis on the individual and his/her household.

This is where businesses run, salaries are paid, farms grow things, factories operate to produce real goods and services.

The term 'Sovereign Authority' refers to the functions which allow our communities and free-markets to operate collectively for the common good.

It this abstract entity has the benefits of specialisation in administration, and it provides the society with an organised system of exchange.

- However, be clear, the term does not refer to the people or the politicians or bureaucrats. THE SOVEREIGN AUTHORITY is US (collectively).

There are three levels of government in Australia: Federal, State and Local Council

And the term Sovereign Authority extends to cover the role of all three -- and we give all three levels the right to demand taxes (including rates, etc.). They are not independent entities even though they are elected as quite separate units:

- The Federal Government has very substantial influence over the states and territorial governments. It awards pensions, pays for education and health care, etc. It also collects the Goods and Services Tax (GST), on most things sold (except essentials) nationwide, and it has power over the Commonwealth Grants Commission (CGC) which has many intriguing formulae for determining which states get what share of the $90 billion dollars collected each year.

- The State Governments are in control of most of the infrastructure being built, especially at the level of utilities and housing. They also run these services and charge such fees as water-rates, almost as if this were a government business enterprise. Australia has 500+ local councils which are almost subsidiary agencies of the State Governments, especially in such matters as allocation of land and the development of housing.

- Of course, our Local Councils tax us at the level of rates. But it is a mistake to think of these as business enterprises. It is impossible to form any judgement on the basis of "price for service" because so many of the important "public good" operations are not readily noticed or measurable. How would you price sewerage disposal for instance?

At this level of discussion we can get away with thinking of State and Federal Governments as the only two levels that matter.

However, the distance of each of these three tiers from the daily routine of human existence, is also an important factor. There's no doubt about the importance of the Federal Government during war ... but there's also no doubt about the consequences of local councils allowing construction of new housing estates to take place on flood plains.

I am increasingly drawn to the idea that all full-time politicians elected to all three levels of government should be paid at the same (slightly generous) rate, since we want the best possible candidates at all levels. We'll discuss this idea later in Benchmarking proposal as a way to reduce inflation.

|

Everyone operates constantly in Australia's free-market environment, either as participants in the production of goods and services, or as the citizenry which consumes these goods. This includes politicians and bureaucrats.

All real goods and services being produced in Australia, and all salaries and pension, are exchanged and consumed within the free-market sector.

The free-market refers primarily to real physical goods, and useful services, and it is organised and run by real humans, and the output is consumed by real humans.

By contrast, the Sovereign Authority is entirely an abstraction -- a way of collectively referring to the various rights, roles and functions of the three levels of government. |

In our democracy we elect officials and award them the responsibility of encouraging enterprise ('greater productivity') but primarily of distributing this national bounty in an EQUITABLE (fair) way.

We need this term 'Sovereign Authority' to be quite clear that we are talking about the functions of government in supervising, assisting, and maintaining the environment in which the free-market can operate to the best (and fairest) of its abilities. It should make very little difference which political party is in power.

We also need to be quite clear that no one suggests that everyone should share the goods and services produced in the nation EQUALLY. We do however expect that the bulk of all individual benefits should flow in a reasonably balanced manner to (a)Those who produce things of benefit to the whole society (b) Those disabled by age, disability, etc. whether they have a history of production or not.

We have had very little public discussion as to the rights of the aged to hand down their legacies to their offspring, given that these people may never have contributed anything.

Until the recent discussion into establishing a Well-being Index we have left it entirely up to the free-market, modified by partisan politics, to determine what we think is "fair", and this, perhaps is the greatest failure in Australia's economic milieu.

For the time being, we need to be sure that we are clearly distinguishing between:

- the current political parties in power; the parliaments; the ministers and their departments, and

- the role these people all play collectively at the Federal, State and Local Council levels.

The term Sovereign Authority refers to the roles only. We give these organisations collectively the rights to demand taxations of many kinds, to build some roads and charge tolls for drivers to use them, and others to have good old roads without tolls. We also expect them to run our "common good" organisations like schools and hospitals ... and a thousand other functions, including defence on a "not for profit" basis.

The Sovereign Authority has the right to resume your land, conscript you to serve in the army, and to jail you for non-compliance with their laws.

More appropriately to this discussion, we award the Sovereign Authority (collectively), the right to create money. They do this specifically to provide the free-market with basic mediation-units called dollars. This serves only one purpose: it is a flexible way to lubricate the exchange of goods and services in the free market.

We also give the Sovereign Authority absolute control over the fair distribution of the products we produce and the services we provide, on the understanding that they will ensure division of these national spoils in an equitable basis.

The key emphasis here is on the fair distribution of the nation's spoils, and this of course involves subjective judgements of fairness. This, supposedly, is what politics does.

For exactly the same reason, governments acting as the Sovereign Authority have also been given the right to extract and destroy circulating money by way of taxation, tolls, fines and whatever.

Governments have two main two main economic functions:

(a) to administer, regulate and control; and

(b) to entitle and incentivise.

Money is merely the way of fairly distributing the nation's goods and services to all citizens, by creating tradable units of entitlement. The workers in the factories get paid in these entitlement units, the executives also, and their investors.

Tradable units of any kind can be created and destroyed, just like any other entitlement. |

Fallacy of Composition:

These distinctions between the individual in the free-market and the government functions of the Sovereign Authority are important because you must have a clear understanding why the rules and incentives that govern the functions of governments, are not the same as those that govern individual and companies operating in the free-market space.

• We also tend to think of governments as just large corporations with a CEO as prime minister, and with similar motives.

This is the cause of most general confusion.

• This common confusion is caused by most people thinking of the abstract and the physical representatives as the same.

This is the same as the token/currency and abstract/money-value confusion. Parliamentarians aren't board members on behalf of the company or the political party, they are representatives of us ("the customers?")

• Partly, this is created by us being plagued nightly by politicians and bureaucrats on our television sets. They are representatives of the Sovereign Authority -- but they are not the Authority itself.

This is not an obtuse distinction, because this confusion leads us into a maze.

You can also look this up in Wikipedia, where you'll find both trivial and more complex explanations. For this reason I have written a seperate explanatory piece on these fallacies because understanding some of the consequences is important in economics. See either a short piece, Composition Fallacies, or a much more general and detailed examination of the complexities 'Fallacies of Compositions' on an adjacent website.

Government Parallels:

We tend to think of the Federal Government in the same fallacious way as simply representing an entity requiring a greater amount of money, than that of an individual or household. We fallaciously see it's role in our monetary system from the viewpoint of an individual, rather than from an Australian national management and improvement perspective.

[They have both a wider picture, and one which has an entirely different focus.]

For instance we generally look on the Cabinet as a distinct organism, but with functions similar to those of a corporate board.

|

The Federal Cabinet

The Cabinet appears to be a board similar to those of a giant nationwide corporation, and we see the Prime Minister as the corporate CEO ... with his Treasurer as the company's Chief Accountant.

From this viewpoint, it is obvious that the Federal Government Corporation needs to earn its money in some way -- from its customers. So we assume this extraction process we call government "taxation": including all forms of money returns like licenses, tolls, fines, etc. is the source of the government's money to run its infrastructure projects, and pay all those public service salaries

To steal a couple of paragraphs from a well-known and first class (Keynesian) economics writer: "Although income tax is the biggest tax we pay, its just one of the many taxes -- federal, state, and local -- we pay. Taxes involve the government making you pay money into its coffers, which is then spent by the government as it sees fit."

This misapplies a residual imagery we have left over from the days of coins and bank-vaults that money is stored in government coffers, etc. just as corporate income is stored in some bank. It also assumes that government's NEED money. When it should be obvious that they create money

The fallacious imagery continues further in the piece: it demonstrates that the writer finds it acceptable to promote the idea that the Cabinet (the corporate's board) must dole our this stored tax-money to various active departments which spend it (hopefully) on more than just bureaucratic staff salaries and Tahitian conferences.

This is not even remotely how it seems. The whole process of money in governments is just a matter of accountants juggling ledger figures.

It's a bit like saying that a ship's cook is desperate to find some salty-water to boil the potatoes, when he's surrounded by the stuff. It's an imagary that we are all prone to accept.

We believe that ... "hopefully, they will spend our tax money on creating "Common Good" assets (hospitals, schools and roads) and in revenue distribution to deserving shareholders (aged pensioners), rather than paying the top bureaucrats half-million-dollar salaries." |

These are the money-concept traps that even the best economists fall into when they try to write casually for the general public in the newspaper. I doubt the economic writer of the above piece really believes there are "government coffers" or shortages of tax moneys: this is just his short-hand way of avoiding a contentious discussion.

But this mental image of the government as being little more than a large corporation, is rarely examined and largely assumed. It lies deeply embedded in our brains, and leads us to imagine that any deficit in the Federal or State government's budget exposes a serious mis-management problem.

We then assume that the deficit is probably due to rash spending. And since politics is so partisan and so divided by economic class, we may also readily accept that deficits are maybe caused by politicians conferring favours on their friends. We constantly find them awarding million-dollar contracts to some of their supporting companies to provide trivial consultative services. This is one of our problems in distinguishing what is economic, and what is political.

Inquiries into some of these expenditures do happen, and probably much more frequently than you'd like to believe. They often don't get exposed in the press and on the broadcast media. But when there are large government deficits, it is wrong to automatically assume that the governing party in power is irresponsible or corrupt in its business dealings.

Governments will end any financial period with a deficit -- usually the smaller ones are just covered up. But deficits more likely to arise from them taking action to reduce adverse economic conditions. It is wrong to fear that deficits might accumulate until the Federal Government goes broke.

This is a Fallacy of Composition.

There's not a chance in the world that our governments can go broke.

Deficits are merely the gap between prediction and reality in government's project spending.

Governments undertake massive infrastructure projects which often take many years to complete, often face serious unforseen consequences, and are no more able to predict climate of international strife that any of us.

I will discuss this further in a section on Fallacies, because the Fallacy of Composition is a mistaken error of thinking that lies largely hidden behind many of our misconceptions about the economy.

In fact, if you think about it ... it is part of the reason why academic economists divide their discipline into "Macro-Economics" (dealing with national-level concepts) and "Micro-Economics" (that of businesses and individuals). And its also why our run-of-the-mill commonsense concepts about government activities are so often wrong.

Why is this important?

Unless you understand these basics you won't understand why money is nothing special. - Anyone can create entitlements ... I can offer to buy you a coffee or a KFC if you mow my lawn.

- Money is an abstract entitlement. The Holder of this entitlement can trade it in any commercial exchange and it will probably be accepted by the vendor. This is because money is created by Federal and State governments, and it is usually linked to physical currency (which establishes authentication locally) -- or by electronics via a secure nationwide banking network.

- Money is an abstract entitlement to a share of the nation's active production of goods and services.

It can also be used in Asset Trading Markets for the exchange of existing items of value.

- However if we are to maintain confidence in traded entitlements, the authentication chain must extend intact back to the Sovereign Authority. Only then can everyone accepting that the entitlements were issued by some trusted national authority. This is what BitCoin lacks.

- The key role played by minted coins and special polymer banknotes in the past provided acceptable local authentication before we had data networks. This role now performed by credit-cards and electronic banking networks which can check and compare the databases attached to both parties in the exchange and ensure the numbers match.

- The mechanism for authenticating money's entitlement is almost as important as the entitlement itself.

|